Innocent Sibonginkosi Ncube

Zimbabweans are expressing their anger after a man who contributed to a 15-year insurance policy received a payout of less than US$1 from Zimnat Life Assurance.

The company attributed this minuscule amount to severe devaluation caused by multiple currency changes over the years, which have drastically eroded the value of the policy.

Details of Currency Changes

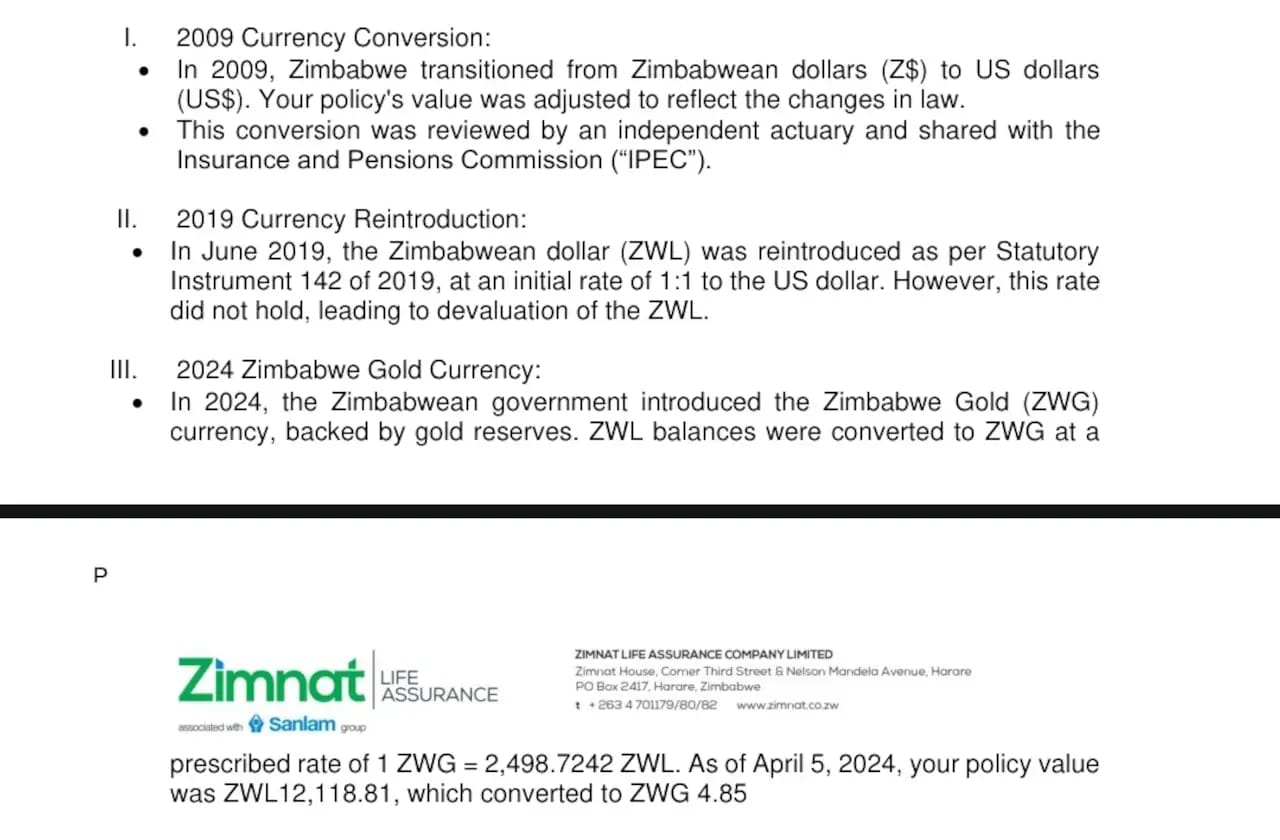

The Zimnat Life Assurance letter, shared on social media, outlined the series of currency conversions that led to the devaluation:

- 2009 Currency Shift: Zimbabwe transitioned from the Zimbabwean dollar (Z$) to the US dollar (US$), adjusting policy values accordingly.

- 2019 Reintroduction of the Zimbabwean Dollar: The Zimbabwean dollar (ZWL) was reintroduced at a 1:1 rate with the US dollar, but this rate quickly lost value.

- 2024 Introduction of Zimbabwe Gold Currency: The government introduced a gold-backed currency, the Zimbabwe Gold (ZWG), which further devalued policy balances. The policyholder’s ZWL balance was converted to just 4.85 ZWG, equivalent to less than US$1.

These changes have led to widespread frustration among Zimbabweans, who feel their savings and investments are being systematically devalued.

Public Reaction

The public outcry has been significant, with many taking to social media to voice their discontent. Comments range from suggestions to invest in livestock instead of financial products to outright accusations of theft against the financial system. Users have described the situation as “pure thievery” and highlighted the exploitative nature of receiving such a minimal payout after years of contributions.

One user remarked, “This exposes serious flaws in government financial policies. A 15-year policy that pays out less than $1 isn’t just unfortunate; it’s exploitative.”

Others are considering financial alternatives outside Zimbabwe, indicating a lack of trust in the local financial system.

Context of Financial Crisis

This incident is not isolated; it mirrors a recent case where a former Chitungwiza Municipality worker, owed over US$5,000 in salary arrears, received just 8 cents. Such occurrences have led many to question the safety of their funds in a financial environment characterized by constant currency fluctuations and devaluation.

As Zimbabweans grapple with these financial challenges, calls for reform and a more stable economic environment are growing louder, reflecting a deepening crisis that affects the livelihoods and savings of many citizens.

Zim GBC News©2024