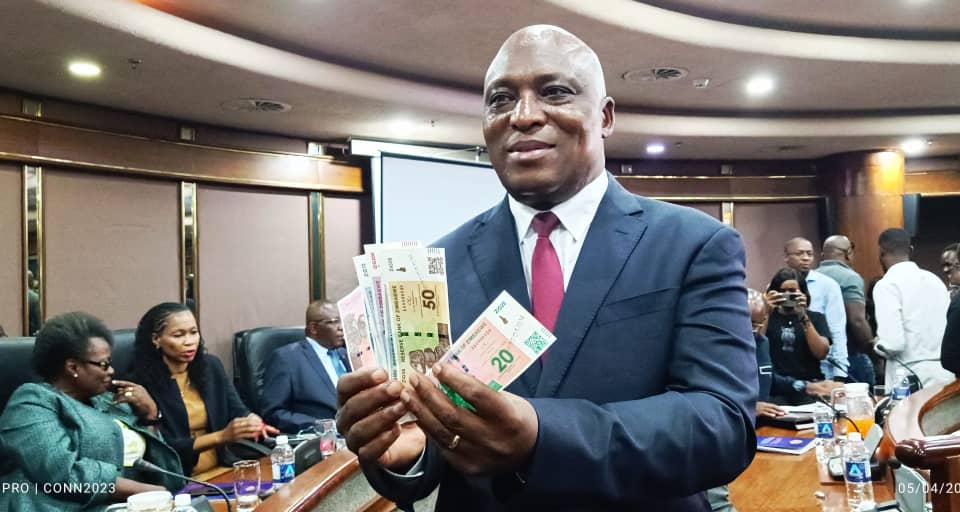

Innocent Sibonginkosi Ncube

The Reserve Bank of Zimbabwe (RBZ) has devalued the Zimbabwe Gold (ZiG) currency by 44%, from ZiG13.99 to ZiG24.39 per US dollar, in a move seen as too little, too late by analysts.

This drastic measure follows mounting pressure to abandon the controlled exchange rate, as premiums on the parallel market surged amidst concerns of arbitrage fueled by the overvalued exchange rate.

The devaluation comes after retailers warned of potential closures due to the choking exchange rate, which prompted suppliers to maintain a two-tier pricing regime for local currency and US dollars. The RBZ has also reduced the amount of foreign currency individuals can take out of the country from US$10,000 to US$2,000 and increased the bank policy rate to 35% from 25%.

Economist Gift Mugano criticizes the move, saying,

“This is an admission by the Central Bank that the ZiG was overvalued… You can only stabilize the exchange rate if you have sufficient foreign currency reserves in the central bank” .

Mugano argues that the authorities have liberalized the exchange rate without sufficient reserves, citing Ethiopia’s US$10 billion injection from Bretton Woods institutions before liberalizing their exchange rate.

Key Implications:

- Increased Prices: Expect a general increase in prices, especially for imported goods.

- Potential Stabilization: The narrowed gap between official and parallel market rates may lead to reduced currency speculation.

- Impact on Savings: Zimbabweans holding ZiG savings will see a significant erosion in US dollar value ².

- Export Competitiveness: Zimbabwean exports may become more competitive internationally due to the weaker local currency.

The move has sparked concerns about inflation risks, trust in the banking system, and wage pressures . As the situation unfolds, policymakers must carefully manage these challenges to stabilize the economy.

Zim GBC News©2024