Business Correspondent

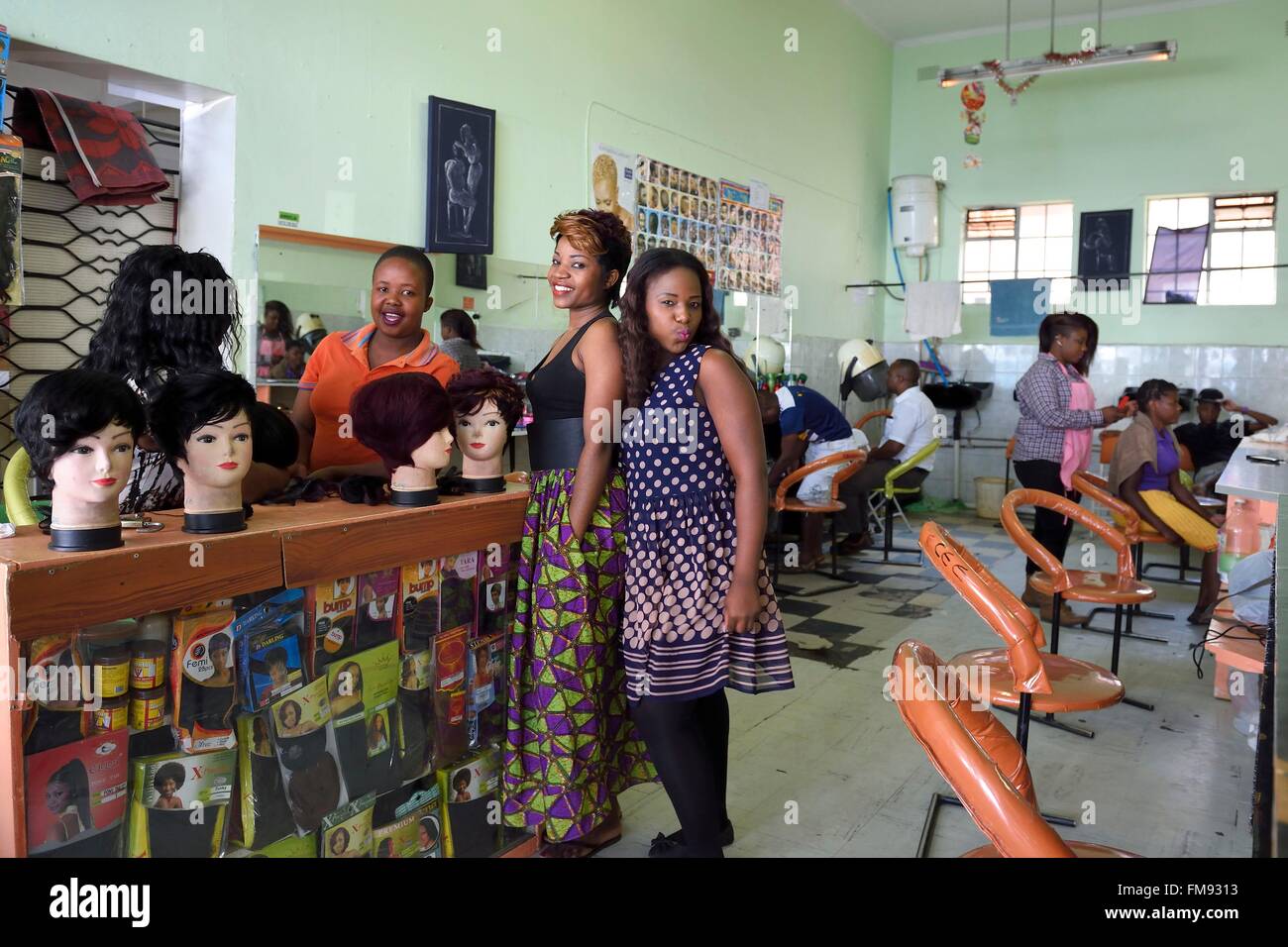

Bulawayo hairdressers are up in arms over the proposed presumptive tax, fearing it will further strain their already struggling businesses.

Finance Minister Professor Mthuli Ncube’s proposal, part of the Finance (2024) Bill, aims to introduce a structured tax regime targeting small-scale operators, including hairdressing salons.

Initially, the tax was set at $30 per chair per month, but after deliberations in Parliament, it was reduced to $5 per chair. However, many hairdressers argue that even this reduced amount is unaffordable. Bevis Ndlovu, a 41-year-old hairdresser, expressed her concerns,

“The government should first deal with unregistered hairdressers working on street corners… We lose customers to them, yet we are being taxed unfairly.”

Ndlovu also highlighted the gendered burden of the tax, as the hairdressing industry is dominated by women.

“Most of us are women, and this will force us to raise prices, but our customers are already struggling.”

Tanya Siziba, another hairdresser, echoed Ndebele’s sentiments, suggesting the tax should be much lower, around $2.

Residents like Mike Ndebele pointed out that many barbers charge between $1 and $2 for haircuts, especially informal operators.

“Before taxing, the government should focus on upgrading salons and barbershops,” Ndebele said.

Key Concerns:

- Unaffordable Tax: Hairdressers struggle to make ends meet with the proposed $5 tax.

- Unregistered Competition: Unlicensed hairdressers undercut registered businesses.

- Gendered Burden: The tax disproportionately affects women-dominated hairdressing industry.

- Informal Sector Realities: Lawmakers debate the tax’s suitability for the informal sector.

Proposed Solutions:

- Lower Tax Rate: Hairdressers suggest a lower tax rate, around $2.

- Upgrade Salons: Government should focus on upgrading salons and barbershops.

- Address Unregistered Competition: Government should address unlicensed hairdressers.

Zim GBC News©2024